First Some basics:

Bitcoin, the first cryptocurrency was first launched in January 2009 by a computer programmers group under the pseudonym Satoshi Nakamoto. Each Bitcoin is divisible to eight decimal places. The smallest unit is a satoshi (sat), which is 1/100,000,000th of a Bitcoin. The Bitcoin supply was capped from the beginning by Nakamoto. The maximum number of coins stipulated to be in existence was 21 million. And around 19.5 Million BTCs are mined so far. The first Bitcoin real-world transaction was carried out by Laszlo Hanyecz who paid 10,000 BTC to have 2 Papa Johns pizzas delivered to him. The pizzas costed about $25. At the peak of BTC`s pricing in 2021, the two pizzas would have been worth north of $680 million.

Crypto rising back

There were many Crypto frauds that happened and a series of exchanges including Sam Bankman`s $32 Bn FTX filed for bankruptcies. A series of crypto related fiascos followed in 2022 and 2023. But finally Bitcoin has started showing resistance in its pricing and has started climbing the wall of worry again.

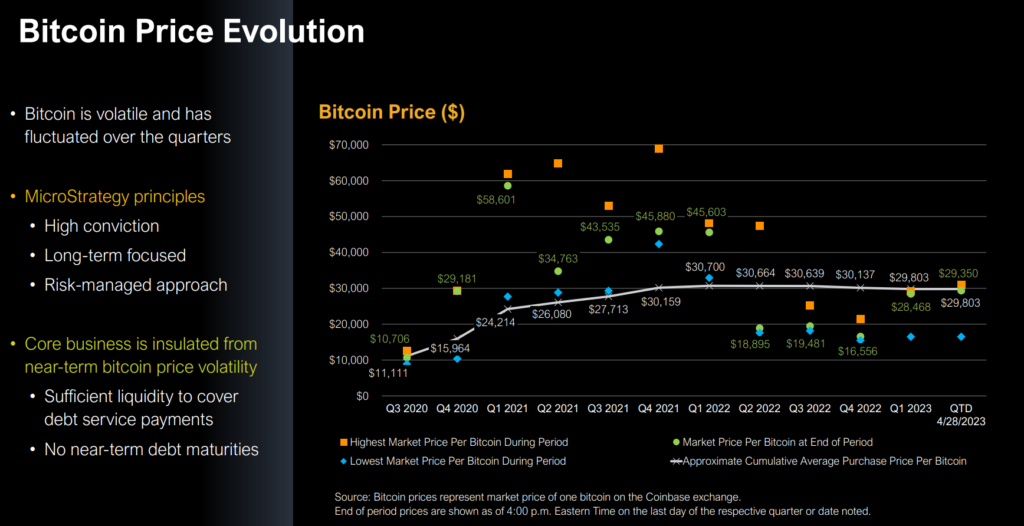

Bitcoin prices fell all the way to $16,500 in Nov 2022 from the peak of $65,000 in 2021. And BTC is up 82% just in 2023.

There was recent article in Barron`s that Crypto is back from dead which was relating to a favorable court ruling that a token trading on crypto exchanges is not an unregistered security as the Securities and Exchange Commission wanted crypto to be treated like a stock from a regulatory standpoint.

Bitcoin, the oldest and biggest cryptocurrency, is the only crypto that the SEC has suggested is actually a commodity. Now none of us are sure whether Bitcoin will crash again to $18,000 levels or will it hit 1 Million$ as some pundits prophesize. One thing to remember before writing off Bitcoin is that it has survived a couple of market cycles over last 13 years.

Bitcoin – Dollar Cost Averaging Strategy:

But recently I deep dived into an interesting business model followed by the BI analytics company Microstrategy company owned by Michael Saylor. He is a staunch proponent of Bitcoin just like some of other Entrepreneurs and investors like Jack Dorsey, Elon Musk and Cathy Wood. Microstrategy is the biggest corporate owning 150,000 Bitcoins in their balance sheet followed by Coinbase, Square.

Microstrategy adopted a strategy in 2020 to use Cash flows from their Cloud based BI Analytics business and buy Bitcoin in their balance sheet every quarter on almost following a Dollar cost averaging strategy. I found this quite intriguing since they have been successfully averaging out the buying price of Bitcoin since 2020.

This has helped the company build a solid BTC position in their balance sheet worth over $4 Billion over last 3 years.

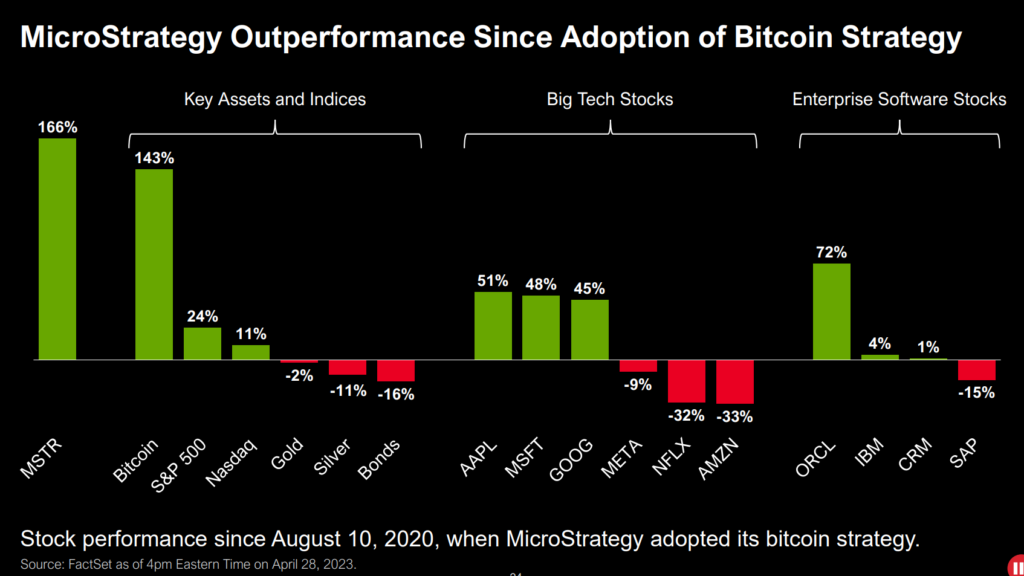

Microstrategy stock is best performer in 2023 being up 216% YTD. The stock has outperformed over last 3 years basis as well outbeating FAANG, NVIDIA and all buzzing AI themes.

How it works?

Now I was never invested in bitcoin or any crypto for more than 2 months since I could never ever muster conviction to hold. I have always been agnostic about its prominence till date and am quite not sure how to value Bitcoin or any cryptos for that matter. So just like dollar cost averaging of stocks, I find dollar cost averaging of Bitcoin very interesting strategy since Bitcoin is not going to go away soon. The biggest risk in buying Bitcoin is the price volatility and dollar cost averaging helps neutralize that risk. And Microstrategy is at the forefront executing that strategy.

Carrying Value Vs Holding Value:

Digital Asset Impairment charges is a huge loss carried in MicroStrategy’s balance sheet which means under standard accounting rules, the value of digital assets such as cryptocurrencies must be recorded at their cost and then only adjusted if their value is impaired, or goes down. But if the price rises, that does not get reported unless an asset is sold. Currently the carrying value is determined based on the lowest price of bitcoin during the reporting period.

Example of Digital Asset Impairment:

On October 1, 2021, a reporting Entity acquired one unit of crypto asset for $20,000. On November 15, 2021, it was observed that the price of the crypto asset had declined to $18,000/unit. Reporting Entity deemed this a triggering event for impairment and wrote down its crypto asset to a new carrying value of $18,000 and recorded an impairment loss for the decline in value. On December 31, 2021, Reporting Entity’s year end, the price of the crypto asset increased to $19,000/unit. But still the Reporting Entity should reflect a carrying value of $18,000 for its crypto asset at year-end and report the full impairment loss of $2,000 in earnings for the period.

So for Microstrategy, aggregate cost of acquiring BTC was ~$4.2 billion and carrying value of the same was ~$2.0 billion, reflecting ~$2.2 billion in cumulative impairment charges.

On March 23, the FASB issued an exposure draft for comment that would cause in-scope digital assets, such as bitcoin, to be measured at fair value. If this gets approved, then real fair value will reflect much stronger valuation for Microstrategy with a simple conversion of holdings of 140,000 Bitcoins.

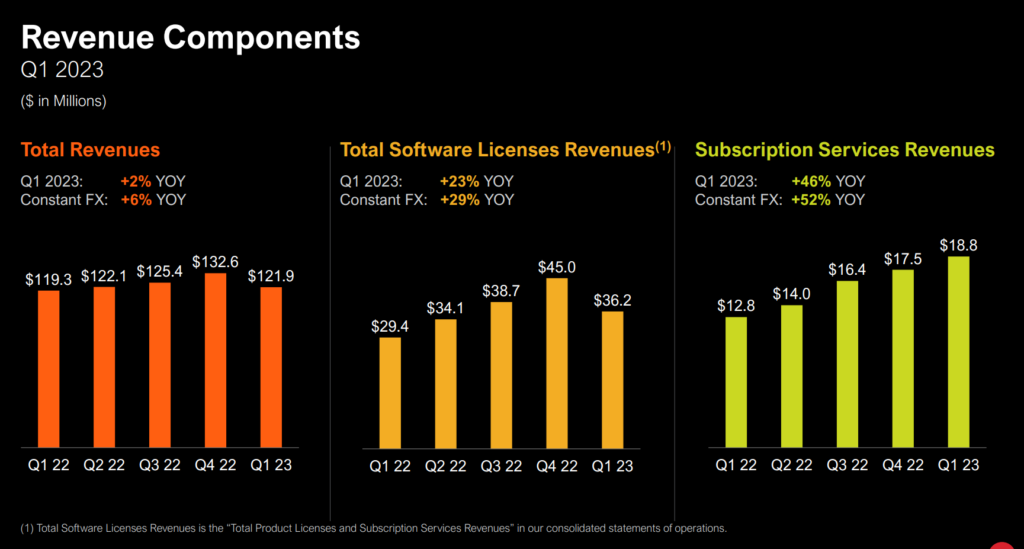

Microstrategy is also a decent business generating cash and growing:

MicroStrategy is a good business still with lots of marquee clients. They are further investing in and enhancing the artificial intelligence (AI) capabilities within its analytics platform, MicroStrategy One. The initial use cases are expected to range from natural language capabilities for generating new visualizations and dashboards, to productivity enhancements related to code, workflow, schema, and content creation. The partnership between MicroStrategy and Microsoft will also aid to their AI related growth. Their cloud based subscription services are growing north of 15% yoy.

Just on sales basis, MicroStrategy is valued at 9-10 times which excludes any Bitcoin holding value on the balance sheet which gives the cushion for downside from this levels.

Asymmetric Bet with Long Term Prospects:

And even better the stock is currently valued at $5.8 billion at par with their Bitcoin holdings of 150,000 which is worth around $4.6 Billion. This might be an asymmetrical bet with low downside but high upside for long periods to come due to factors like:

- Very low upside due to cheap valuations if fair value reporting comes into effect for Bitcoin pricing

- Huge upside for many years to come due to a strong underlying cloud based business (AI and Analytics) that generates cash

- Price Derisking with Dollar cost averaging strategy for buying BTC

- Multiple tailwinds for Bitcoin ahead like 4th Halving, Fair value approval, Regulatory streamlining, Corporate adoption, Wide scale Sovereign adoption ( US is the largest holder of Bitcoin among all countries by the by)

Disclaimer: This post is just a discussion on the successful strategy of Dollar cost averaging of Bitcoin and should not be construed as any investment advise. The author might have vested interest or holding in any of the discussed assets or securities.