I had recently put out a post about the importance of taking asymmetric bets (Low risk-High Returns) in life and I was asked “What are asymmetric bets and how to make those bets to change one`s life?” I mean the question is genuine like how can we have a bet with low risk but high return? Its counter-intuitive to what we are all taught in schools and MBAs that you have to take high risk to reap high rewards in finance and investing. To that extent, can asymmetric bets of low-risk and high-return exist in real world?

Of course there are risks associated with asymmetric opportunities as well. But the risks are downside protected with huge upside returns. Now what are some of those asymmetric opportunities in life? James Clear, the author of “Atomic habits” once collated a list on twitter, few of them like:

Investing in a start up

Writing a book or starting a Podcast

Create a product (software)

Investing in Equities

These are asymmetric opportunities available for everyone out there who can take advantage based on their line of interest or passion. Think about it, what is the downside in pursuing any of the above opportunities as a part time in life and eventually making it full time? Close to none. But think about the upside potential? Its huge and can really change one`s life for good.

How to take smart decisions (bets) to stack odds in your favor?

Life is all about making thousands of small decisions we make every day and there are occasionally few major decisions like career, marriage, kids, where to settle down, investing etc. I recently read a book called “Thinking in bets” written by Annie Duke who was a poker champion and winner of World Series of Poker (WSOP) gold bracelet from 2004. She says in this book “The strength of thinking about every decision as a bet is that you stop to gather more information and think more logically. When you start to think of decisions as bets, you begin to see a range of possible futures and adjust your degree of certainty accordingly. ” To take smart asymmetric bets, she has a formulae:

Expected Value = Possible Reward x Likelihood of reward

You should always make a decision that has a positive expected value. A positive expected value is when the expected value is greater than your personal cost. Personal cost includes the time it takes to carry out your decision and the cost of money and attention you have to commit.

Lets take an example of how to make an asymmetric bet in stock market investing? This is one place where we take investing decisions under heightened conditions of uncertainty about future prospects. We are investing in a company for its future cash flows that is uncertain and difficult to predict for more than a couple of years. So we need to increase expected value of outcome by increasing both factors ie possible returns and likelihood of that return. This happens when we search for stocks in the most hated countries or sectors or companies. As legendary investor Howard Marks puts it ““The safest and most potentially profitable thing is to buy something when no-one likes it. Given time, its popularity, and thus its price, can only go one way; up.”. Basically we are increasing the likelihood of reward by investing at times of maximum pessimism.

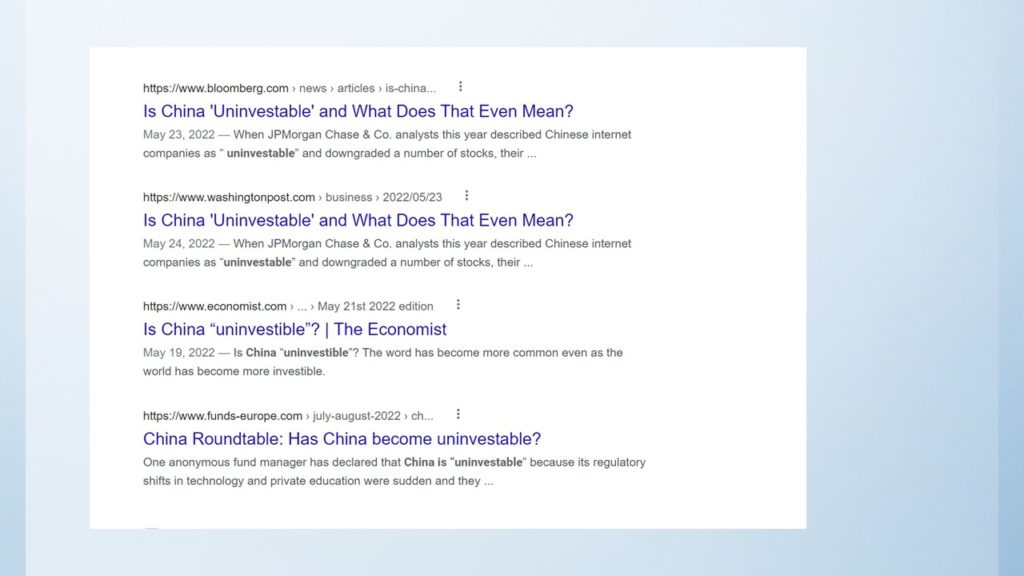

Here is a practical example that happened in recent times. There was a popular dogma on all leading global news papers that “China is non-investable”. Here is an asymmetric opportunity that arose in second half of 2022. How can a country that is second largest economy in the world and had proven over last 3 decades that it wants to be and will be a successful economic super power in the world deteriorate into shambles? It clearly became a hated investment destination during second half of 2022.

Look at the leading tech stocks performance over last 3 months once the perception changed. All we needed to do was to load up on such asymmetric opportunities where downside is very limited but upside could be 3 or 4 times up.

We always get such asymmetric opportunities in life. All one has to do is to have an open mind and be aligned to make smart decisions or make bets where odds are stacked more towards their favor. Of course luck has its role too…