‘The Intelligent Investor’ by Benjamin Graham is the most commonly referred book for beginners in Investing field. While there is no doubt this is a great book as often quoted by Warren Buffett, the traditional concept of value investing is actually anti-thesis to creating wealth through the principle of compounding.

What is great about the book? Margin of Safety: The most famous concept introduced by Benjamin Graham was the ‘Margin of Safety principle’. This definitely is the highlight of the book as well as a path breaking idea in the world of equity investing. Margin of Safety in its crude definition states buying something that is worth $1 for 60 or 70 cents. In other words, Margin of safety is a principle of investing in which an investor only purchases securities when their trading price is significantly below their intrinsic value. This gives sufficient cushion for investors against market volatilities. Second great idea from the book is to look at investing in stocks as part ownership of businesses.

Now why traditional value investing approach practiced by Benjamin Graham is anti-thesis to the concept of compounding?

To answer this question, we need to understand what he practiced through value investing approach. The approach states to buy a security whose intrinsic value is $1 but buying it for 60 cents. And sell the security, when the stock retraces back to its intrinsic value thereabouts. Lets see what are the issues with this approach?

- Reinvestment risk: The biggest risk every time you sell a security is, to find another idea to reinvest that money. This will be a non-stop process if we practice Graham`s traditional value investing process. We need to keep selling securities and keep buying the next bargain. This causes reinvestment risk because, one its extremely difficult to keep finding bargains and two, we are increasing the probability of errors by taking so many attempts of reinvesting.

- Interrupting Compounding Process: The biggest disservice an investor can do to his or her portfolio is to keep interrupting their compounding process. Great Companies continues to grow 50 times or 100 times over long term. So how can investor achieve a 100X returns when we sell after it doubles or triples following traditional value investing methodology. Charlie Munger once said famously,

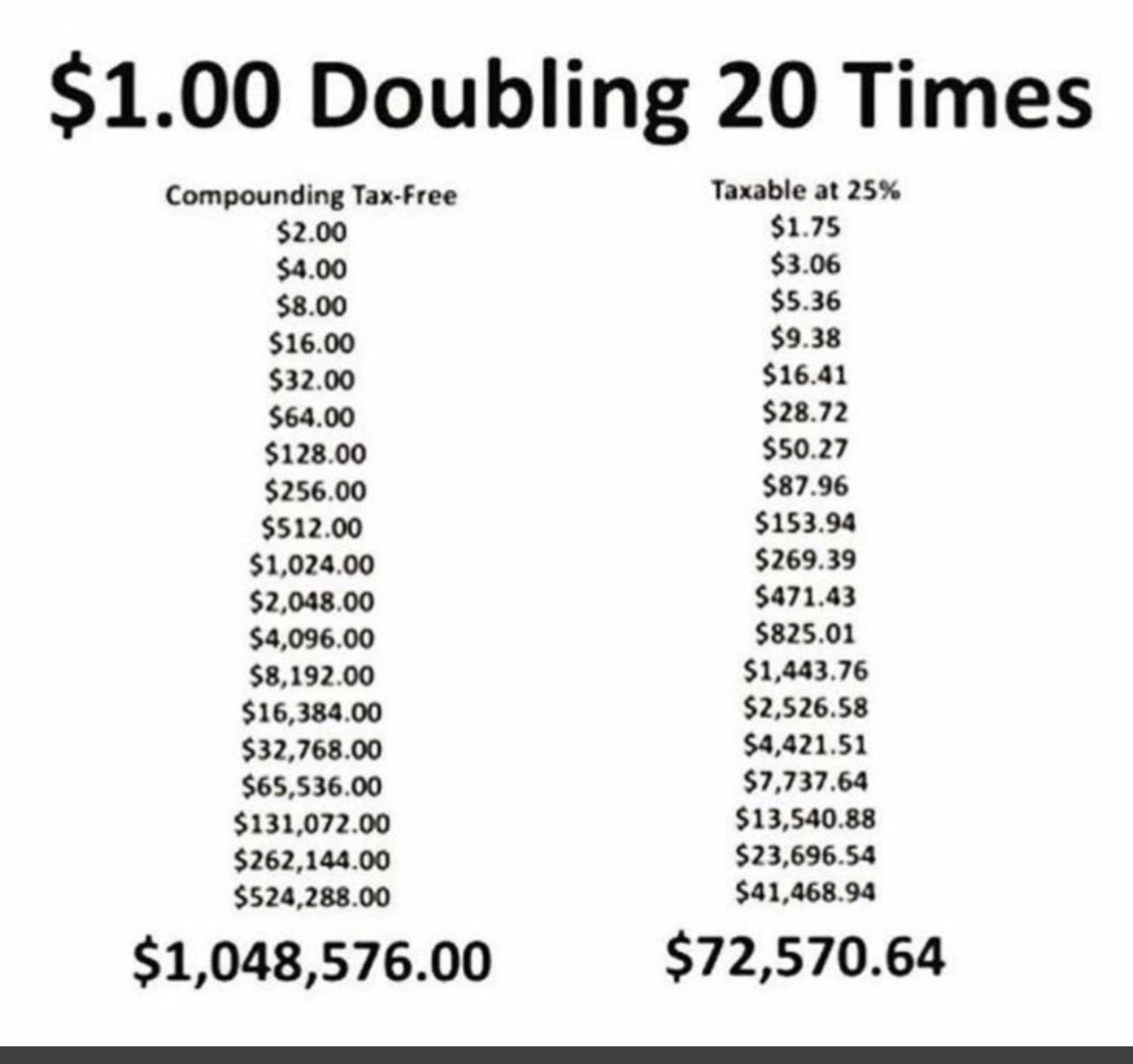

- Frictional Cost: The biggest issue with constantly selling securities and booking profits is Tax. Take a look at the table below how much Tax can affect compounding as a frictional cost. This is a serious dragger on the process of compounding. Over 20-30 years period of compounding, the returns can come down by 5 – 10 times which is huge.

But does that mean you should never sell securities that you invest in? No, its just that we need to find investing ideas with long runway and buy it at a decent bargain. If we did the job right in identifying the right business, then selling becomes relatively an easy decision which is “Few years later when the growth has runout”