THE IMPEDIMENT TO ACTION ADVANCES ACTION. WHAT STANDS IN THE WAY BECOMES THE WAY — MARCUS AURELIUS

Hitting the rock bottom would mean facing any type of adversities in life and it is not easy for anybody to face adversities. But stoic philosophy teaches otherwise as I began this post with a quote by the famous Roman emperor Marcus Aurelius. The stoics guides us that adversities are the greatest opportunities in life. Again that could really be true when we remember all the adversities that has happened in our own lifes but in hindsight.

Am not delving further into philosophy. Now time for a physics concept that we have all learnt. That`s Newton`s second law of motion which states that the rate of change of a body’s momentum is equal to the net force acting on it. Hold this thought for a while.

Am an investor and am going to explain how to benefit from this concept of handling rock bottoms. I love this work of investing because it is multi-disciplinary by nature. Now if we apply these concepts in Investing, there can be huge wealth created. But how?

George Soros is definitely the best investor the world has ever seen whose fund generated an average annual return of 30% over a 30-year period from 1970 to 2000.Though am not a fan of the billionaire investor Soros who pocketed $1 billion by betting against the British pound in 1992, I have always followed one of his quote in my investing process which goes by “The worse a situation becomes the less it takes to turn it around, the bigger the upside”.

But what happens when investors face the worst situations? Most common human reactions are panic and extreme fear during adversities in the markets. When markets hits the rock bottom, that is exactly the point of extreme pessimism and lowest expectations. When the expectations are the lowest, it takes a small trigger of positive impulse (net force) to turn around and the upside could be biggest, if the law of momentum sustains.

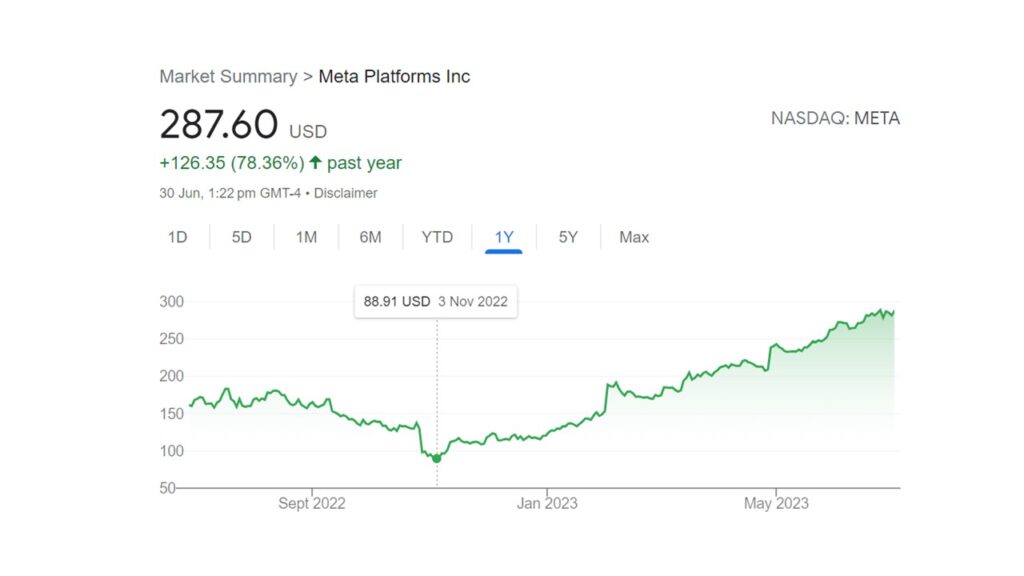

Consider Meta (Facebook) stock that saw the most dramatic devaluation in November 2022 as the stock hit the rock bottom of $88. The whole Wall street community called it the end of social media giant. Now that was really the rock bottom and it took few harsh measures from the management to turn it around and the stock saw the highest upside. Meta stock went up 3X in 6 months !!

The Only Way is Up

The good news is, once you’ve hit rock bottom, you know you can’t possibly go any lower. You realize the bottom is actually a great springboard from which to push yourself up. This is true whether its in investing or any other aspect in life. So next time we face any adversity, the point where we feel our weakest, just understand this -> things can only change for the better. The only way is UP !!