Has this happened to you before? A wrong decision you took turned out to have an incredible positive outcome that you didn’t expect. And the outer world like your friends, communities lauded your brilliant decision. This could have happened to many leaders, sports team managers, captains. Now the interesting aspect is that you dont realize it was a wrong decision at that point of time before execution but rather at a later point of time after the event occurred.

Or the other way around. A perfectly right decision you thought ended up being a complete failure! Why do these things happen? Because we often underestimate the influence of multiple extraneous factors like luck, probability on the actual outcomes and we overestimate our ‘cognitive illusion’ of control over the outcomes.

Behavioral scientists Daniel Kahneman and Amos Tversky demonstrated with numerous examples of what are known as “cognitive illusions”. The cognitive illusions that they introduced delivered empirical evidence that people’s reasoning abilities are deficient with respect to the laws of logic and probability. People give too much credit to the Outcomes and very less credit to the process behind.

So What can we really control?

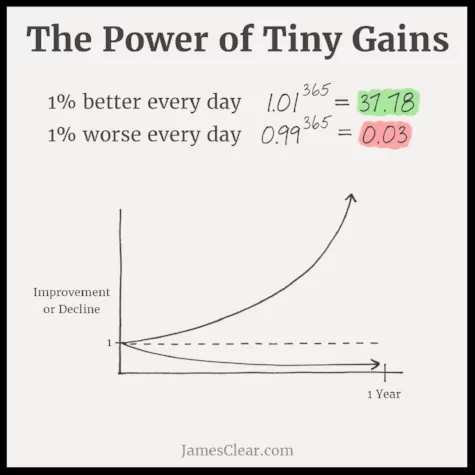

What we can control is the process behind and fine tuning that process in such a way that we improve the odds of our decisions going right in our favor. Basically stacking the odds (probability and luck) in our favor by focusing on the process and preparation. We should not obsess over the destination but rather focus on the journey. Now the key thing here is you need to love the journey or the process so much that you are able to focus and follow that consistently, and sometimes even improvise. Warren Buffett, one of the world’s most successful investors, is a perfect example of process over outcome.

As Stoic philosopher Marcus Aurelius said, “it’s insane to tie your wellbeing to things outside of your control. If you did your best, if you gave it your all, if you acted with your best judgment—that is a win…regardless of whether it’s a good or bad outcome.”.

But my favorite lines on this topic was said by the famous actor Will Smith. He said “You don’t set out to build a wall. You don’t start by saying, ‘I’m going to build the biggest, baddest wall that’s ever been built.’ You don’t start there. You say, ‘I’m going to lay this brick as perfectly as a brick can be laid.’ If you do that every single day, soon you will have a wall.”