Shortest distance between 2 points is a straight line and our human brains are wired to think straight and linear. Decades of deep research in cognitive psychology shows that the human mind struggles to grasp nonlinear relationships. But the world is a non-linear one out there, whether its relationships, technology innovations, business growth, climate change or even making wealth.

While like in any bell curve, thinking straight and linear helps in our day to day activities which occupies 80% of our mind/ time space, we need to shift our thoughts to exponential when it comes to gaining edge in careers, innovations, businesses or networks. That shift to remaining 20% of the bell curve helps.

How to Shift to Non-Linear Thinking? Lets understand with some practical real life examples.

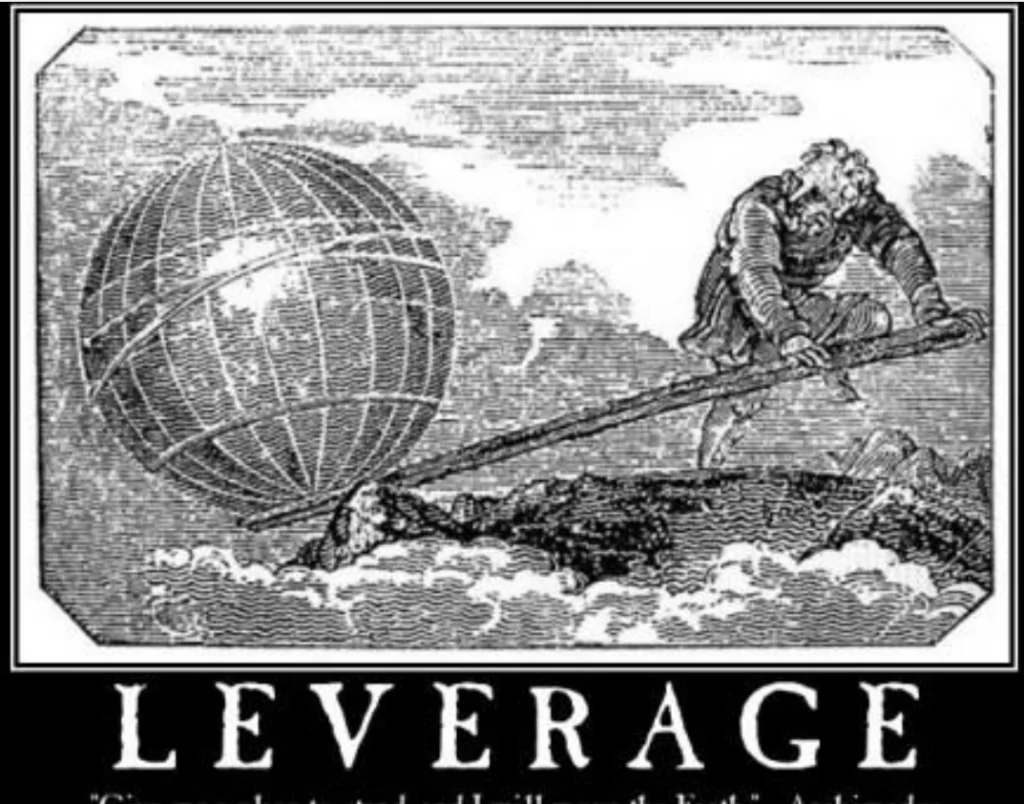

1. Understand Leverage (Archimedes Lever):

Story of Facebook and Threads: It took 4 and half years for Facebook to reach first 100 Million users on its platform. The same company now called Meta launched Threads to compete with Twitter (now called X). And guess what? Threads took 5 days to reach 100 Million users on its platform. How did this happen with no promotions? Threads allowed Instagram users to automatically follow their users on the new service, giving it a quick boost in amassing new signups. Meta just leveraged its massive 2 Billion user base in Instagram. This word “Leverage” will repeat a lot because its closely linked to non-linear results. One of my favourite quotes was from the most influential scientists in history Archimedes who said “Give me one firm spot on which to stand, and I shall move the earth.”

Even ancient Egyptians used levers to lift heavy stones like 100s of tons in order to build the pyramids and obelisks. The concept of leverage can be applied across areas of life like building a business using financial leverage, building a network leveraging the connections. Concept of applying leverage simply means small changes applied at the right points in optimal balanced way can achieve super normal large outcomes (Non-linear)

2. Lindy Effect: Power of Consistency with Incremental Gains:

The Lindy Effect is the idea that the older something is, the longer it’s likely to be around in the future. And the old idea of building brick by brick consistently leading to incremental gains will never die and this idea is likely to lead the world for centuries ahead.

Examples: India`s Growth Story: In 1820, India’s GDP was 16% of the global GDP. For over 1700 years, India was the richest country till British colonized and looted the country and left to rags. India took Independence in 1947 and the GDP of the country at that time was less than $30 Billion. It took 60 years for India to reach the First Trillion Dollar GDP. The next Trillion came in less than 5 years and the next in 3 years and the next could be in a year.

Tesla Growth Story: It took 12 years for EV leader Tesla to build its first million vehicles. Recently Tesla Just Built Its 4 Millionth Vehicle, Seven Months After It Crossed 3 Million Mark.

Whether its a country or a company, these growth stories are perfect examples of Non-Linear Applications in life.

3. Compounding (Snowball Effect):

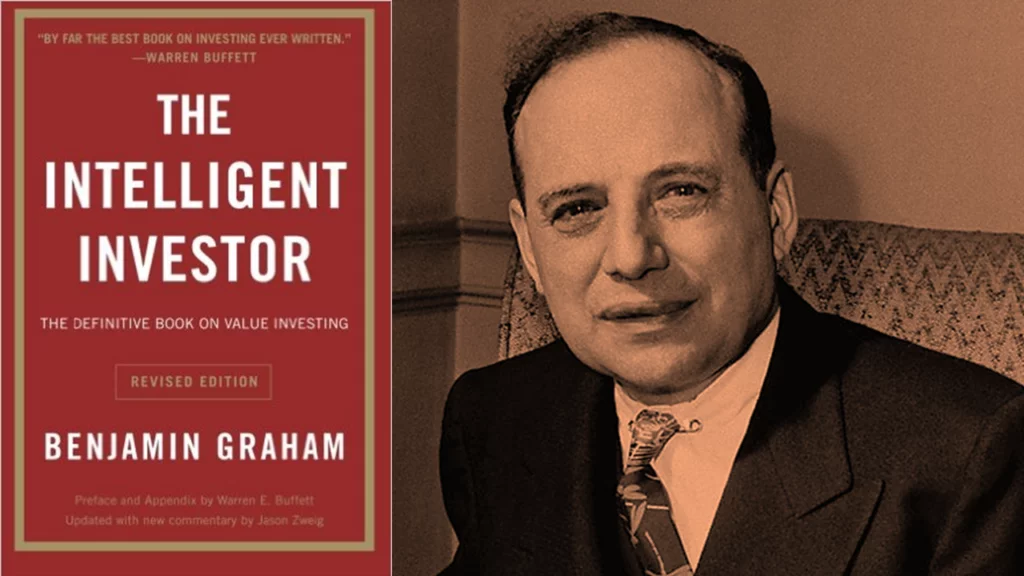

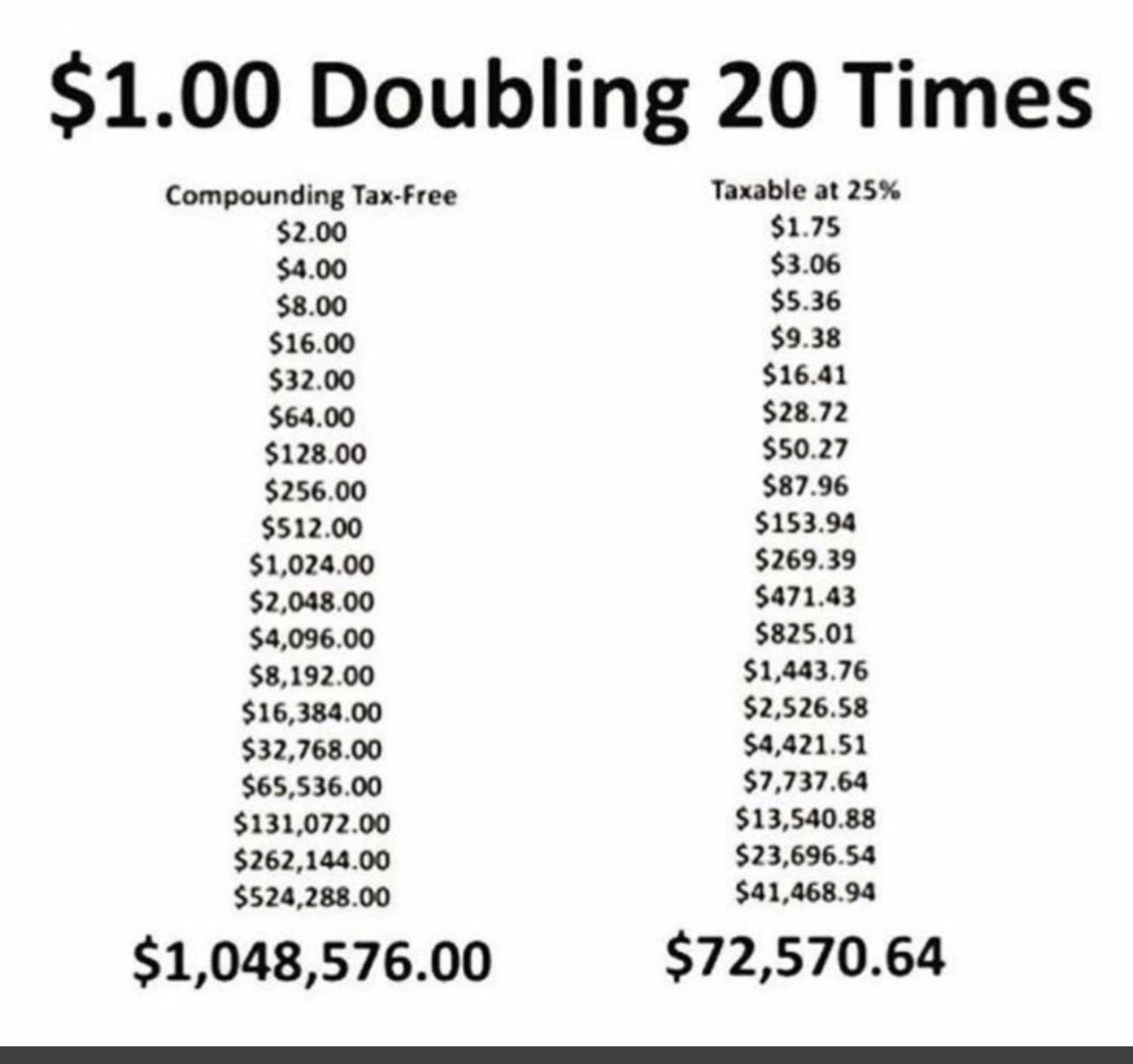

Einstein called it the 8th Wonder of the world for a reason. Principle of compounding is difficult because human minds cannot perceive geometric progression. We can easily calculate linear progression in minds but when it comes to geometric progression, it gets extremely difficult beyond a few steps. Warren Buffett compares it to the Snowball effect.

When you push a small snowball down a hill, it continuously picks up snow. When it reaches the bottom of the hill it is a giant snow boulder. The bigger it gets, the more snow it packs on with each turn. The snowball effect explains how small actions carried out over time can lead to big results.

Compounding is mostly considered as a wealth creation phenomenon but it applies to every aspect of life. Whether it is compounding knowledge or skills or relationships or habits, this non-linear principle applies.

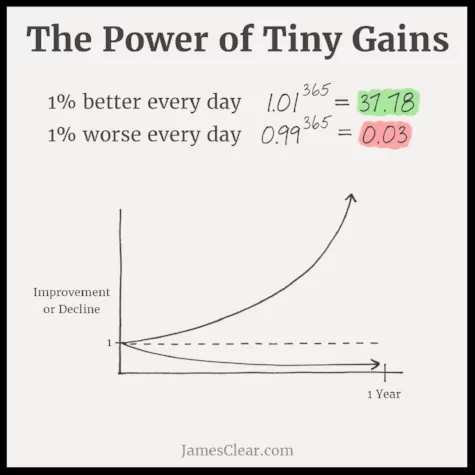

The best book I`ve read in recent times was Atomic Habits written by James Clear and he has best comprehended compounding in a picture. Take a look at the image below.